The IRS confirmed last month that the average tax refund this year is about $2,945. Many Americans have already started receiving their refunds in their bank accounts.

Who Gets a Refund?

If you filed your federal income tax return between mid-April and May and paid more taxes than you owed, you may be eligible for a refund.

How to Track Your Refund

The IRS offers a free online tool called “Where’s My Refund” where you can check the status of your refund. To use it, you’ll need your Social Security Number (or taxpayer ID), filing status, and the exact amount of your refund.

The tool will tell you when your return has been received, approved, and when your refund has been sent.

Why Might Refunds Be Delayed?

Several factors can slow down refund payments, including:

- Filing a paper tax return instead of filing online (paper returns take longer because IRS workers must review them manually).

- Choosing to get a refund by mailed check instead of direct deposit (mailed checks take extra time to arrive).

- Errors in your tax return, like incorrect bank info or missing details.

- Applying for certain tax credits or benefits that require extra review.

- Recent IRS budget cuts and staffing shortages may also cause delays.

Tips to Get Your Refund Faster

- File your taxes online (e-filing).

- Request direct deposit for your refund.

- Double-check all your personal and banking information before submitting.

- Include all required forms and documentation.

June Refund Schedule

Here’s when refunds are expected to be sent based on when you filed and how:

For returns filed May 1 – May 15:

- Online + Direct Deposit: May 22 – June 4

- Online + Mailed Check: May 29 – June 11

- Paper Filing: June 26 – July 10

For returns filed May 16 – May 31:

- Online + Direct Deposit: June 6 – June 19

- Online + Mailed Check: June 13 – June 26

- Paper Filing: July 11 – July 25

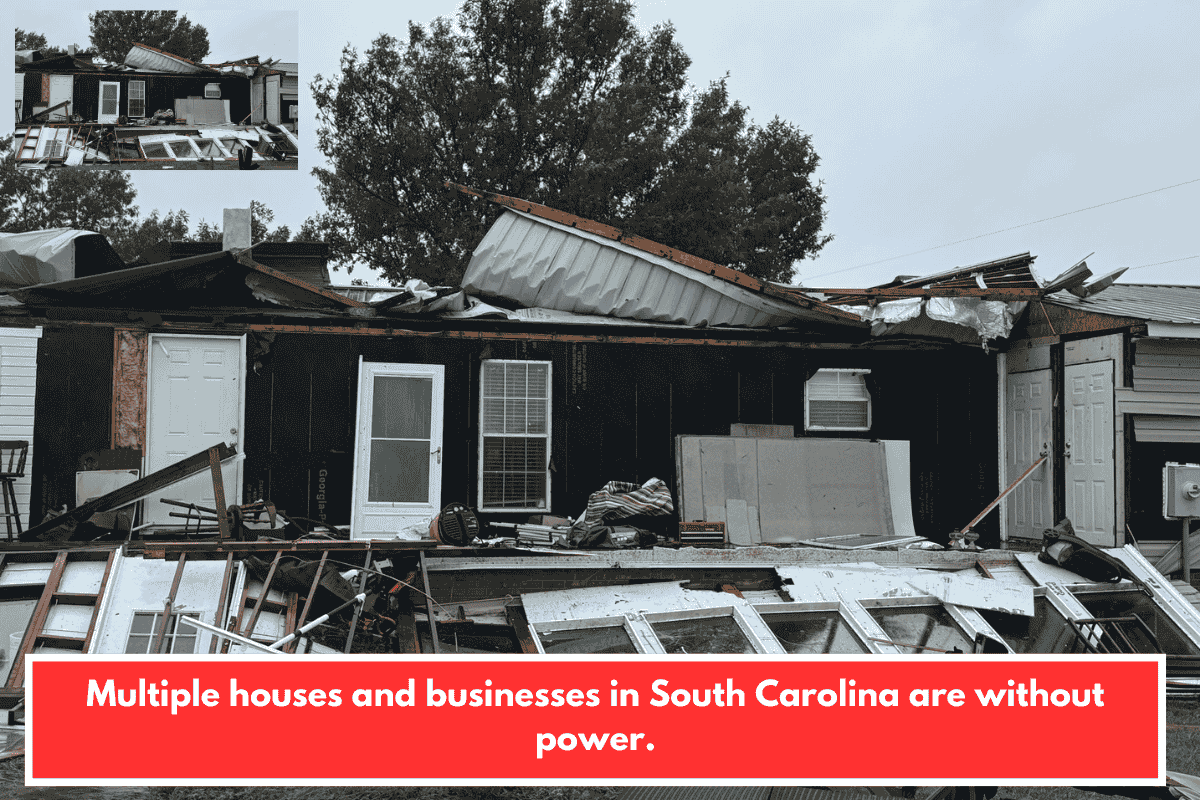

Tax Filing Extensions for Disaster Areas

The IRS granted automatic tax filing and payment extensions to 12 states affected by natural disasters. Deadlines vary by location, with some extending into fall 2025.

- All counties in North Carolina: September 25, 2025

- Los Angeles County, California: October 15, 2025

- Counties in Arkansas, Kentucky, Tennessee, and parts of West Virginia: November 3, 2025

You can check the full list of extended areas and eligibility on the IRS website.