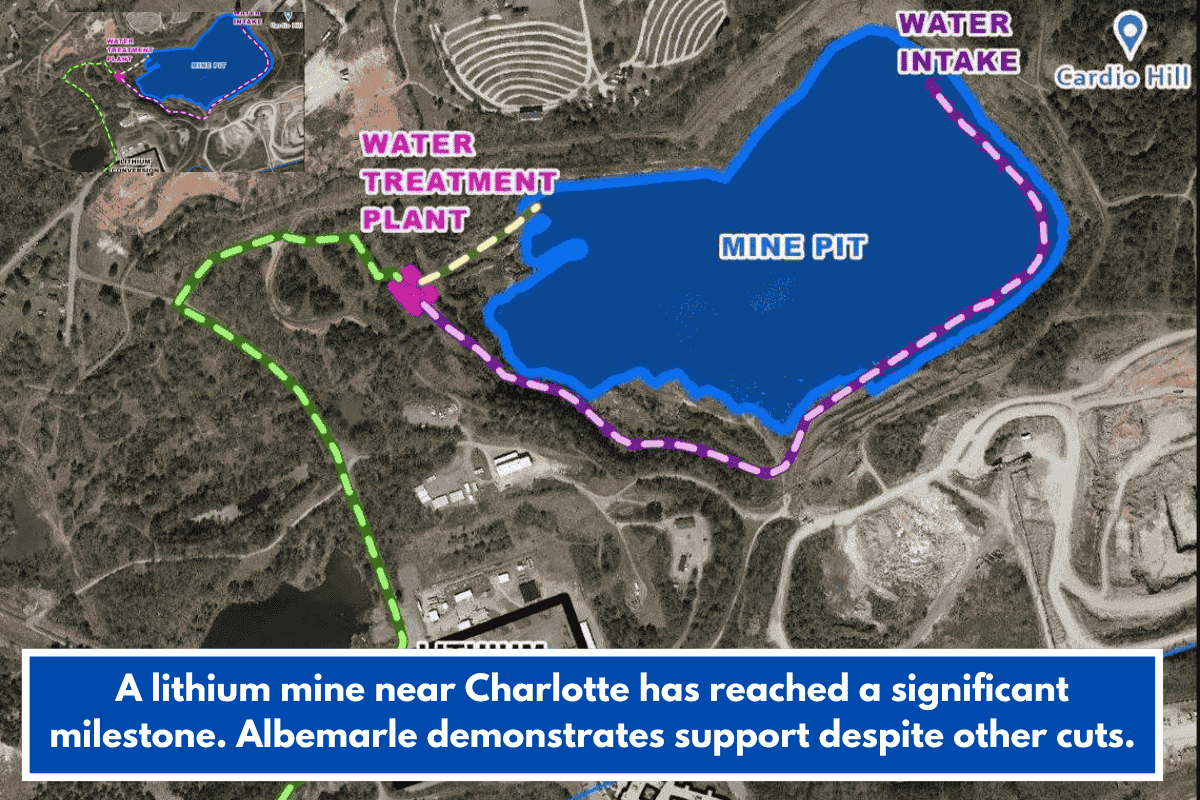

Albemarle Corp. hit a key step in reopening its dormant lithium mine in Kings Mountain, North Carolina, by completing dewatering of the open pit this month. They treated and discharged 1.57 billion gallons of rainwater accumulated since the 1990s. The site also wrapped a successful drilling campaign (nearly 42,000 feet over 30,000 hours), setting up a potential resource update next year. Once running, the mine aims to produce 420,000 tons of lithium-bearing spodumene concentrate annually, using stormwater for operations. This pegmatite deposit is vital for lithium in EV batteries and electronics.

Financial Snapshot and Cost Cuts

Q4 revenue rose 16% to $1.4 billion, with full-year at $5.1 billion (down 5.6% but beat forecasts), thanks to energy storage growth and efficiencies. However, lithium price drops led to challenges: they’re temporarily shutting the Kemerton plant in Australia for cost savings, targeting $100–150 million more in reductions this year via AI, supply chain tweaks, and flat capex (down 65% prior year). Workforce shrank to 7,800 globally (down 500), including cuts in Charlotte (now ~900 from 1,100). Recent divestitures bring $660 million cash for debt reduction.

Strategic Outlook

Albemarle prioritizes Kings Mountain and Chile’s Salar de Atacama while deferring Carolinas projects like Richburg, SC’s $1.3B facility. They raised 2030 lithium demand forecast by 10%, driven by 80%+ growth in grid-scale storage for renewables, data centers, and AI. 2026 demand projection: 1.8–2.2 million tons (15–40% YoY rise).

This balances cost discipline with U.S.-based lithium supply chain bets amid market volatility—relevant for South Carolina’s economic ties, like past deferrals in Chester County. What’s your take on how this impacts local jobs or EV supply in the region?