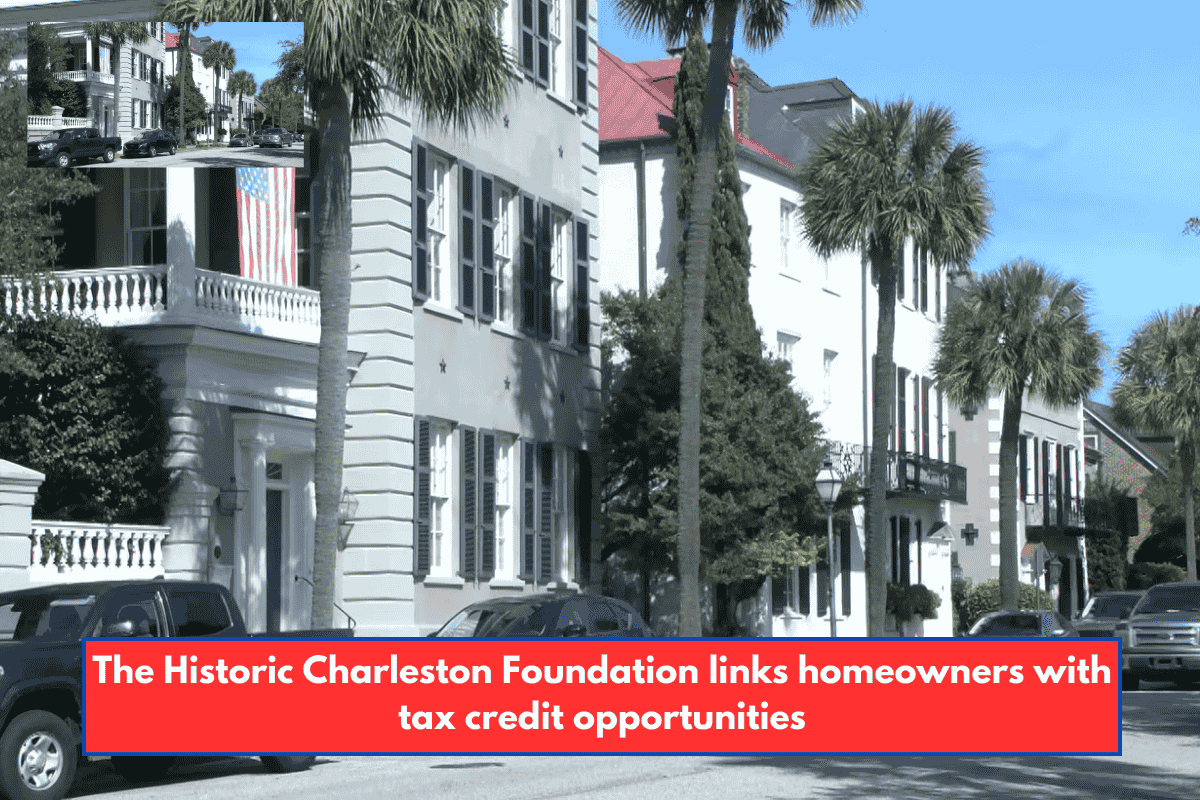

Charleston, South Carolina – The Historic Charleston Foundation is striving to assist property owners in discovering underutilized cash streams that can reduce the expense of maintaining historic homes.

The foundation has established a free easement education series to connect homeowners with tax credit programs available through the State Historic Preservation Office. Leaders stated that the credits are still largely underutilized.

More than 400 properties in Charleston are eligible for rehabilitation tax credits, but just seven approved projects were reported throughout the state last year. Roofs, shutters, porches, external walls, doors, and other minor or large changes are all eligible for repair.

“You really just kind of have to do the due diligence to find it because it’s not like people are coming out every day saying, ‘Hey, these are your options,'” Historic Charleston Foundation spokesperson Liza Holian said. “When it’s not in their face all the time, they might just go by, ‘Here’s the quote, I’m going to pay what I need’ so that’s part of where we like to try to help.”

According to the organization, tax credits can reimburse between 20% and 25% of approved expenses. Leaders believe such support might be substantial in a city where the high expense of maintenance is the most significant barrier for residents trying to preserve historic houses.

“We understand the costs associated with historic homes, including materials, labor, and their rarity, and are working to reduce them.” So, we’re fortunate that Charleston has these resources,” Holian stated.

The foundation intends to continue the education series in the following months with additional topics, such as property insurance, as part of a larger effort to protect Charleston’s status as the birthplace of preservation.